marin county property tax exemptions

By applying for the Homeowners exemption you can save approximately 70 on your property taxes each year. Application for Real and Personal Property Tax Exemption.

Property Tax Exemption For Live Aboards

Please contact the districts directly at the phone numbers located under your name and address on the front of your property tax bill for exemption eligibility requirements or visit the Marin County Property Tax Exemptions website.

. Individuals who may qualify include those who are seniors disabled low-to-moderate income or have special circumstances eg medical conditions that require extra water. Calculating The Transfer Tax in Marin County. This would result in a savings of approximately 70 per year on your property tax bill.

For residential real estate one of two methods is normally employed when contesting your billing. If you enter your parcel number the website pulls up a list of all the exemptions for which you are eligible that show up on your tax bill. Tax exemptions especially have been a rich area for adding new ones and restoring any under scrutiny.

There is also a full list of such exemptions countywide. Please contact the districts directly at the phone numbers located under your name and address on the front of your property tax bill for exemption eligibility requirements or visit. For Lease or Lease-Purchase Property Owned by a Taxable Owner and Leased to an Exempt Public Body Institution or Organization 150-310-087.

To qualify for a low-income senior exemption for the Measure A parcel tax for a single-family residence you must. The Marin County Homestead Exemption can reduce the appraised valuation of a primary residence before calculating the property tax owed resulting in a lower annual property tax rate for owner-occupied homes. Discover public property records and information on land house and tax online.

Ad Search Any Address in Marin County Get A Detailed Property Report Quick. Find Marin County Online Property Taxes Info From 2022. These exemptions include churches non-profits and local governments that meet the standards for exemption from ad valorem tax ie the basic property tax.

If Marin County property taxes have been too costly for your wallet. If you meet certain requirements involving age income andor residency or you own a contiguous or low value parcel please search by parcel number or fund number to learn more about potential exemptions for your property. Theyre known as sales comparisons and unequal appraisals.

Because so many tax- and rate- payers miss out on a cost. To receive the full homeowners exemption the property owner must reside on the property January 1 and file the homeowners exemption claim form with the Marin County Assessors. 1 be 65 years of age or older by December 31 2017 2 own and occupy your.

Look on your tax bill for your Parcel Number or APN. Ad View public property records including property assessment mortgage documents and more. If you are over the age of 65 and use the property as your principal residence you may be eligible for a parcel tax exemption.

Some states specify exemptions such as a sale resulting from a divorce or death a transfer from parent to child gifts and transfers between partners. Measure C Zones and Boundary. Learn About Your Senior Exemptions.

Exemptions to Transfer Tax in Marin County. The Marin County Tax Assessor can provide you with an application form for the Marin County homestead exemption which can provide a modest property tax break for properties which are used as the primary residence of their owners. If you claim an exemption you must submit written documentation proving the exemption at the time of recording.

For Property Leased by an Exempt Body to Another Exempt Body 150-310-085 Application for Real and Personal Property Tax Exemption. To qualify for a Measure A senior exemption you must be 65 years of age or older by December 31 of the tax year own and occupy your single-family residence located in the Measure A tax zone of the Marin County Free Library District. Time is short to submit applications for exemptions and discounts on an array of Marin add-on property taxes and agency fees.

All homeowners in Marin County may be eligible for a 7000 exemption on the assessed value of their primary home. Because so many tax- and rate- payers miss out on a cost. This should look like 099-999-99.

Exemptions are available in Marin County which may lower the propertys tax bill. Individuals who may qualify include those who are seniors disabled low-to-moderate income or have special circumstances eg medical conditions that require extra water. The county provides a list of exemptions for property tax items that apply tour property.

To qualify for a senior low-income exemption you. These are deducted from the assessed value to give the propertys taxable value. If you are over the age of 65 and use the property as your principal residence you may be eligible for a parcel tax exemption.

Time is short to submit applications for exemptions and discounts on an array of Marin add-on property taxes and agency fees. Other types of property tax exemptions can be found on the Assessors website exemptions page. 13 rows Marin County Property Tax Exemptions.

Exemptions and Taxable Value. Owner must be 65 years old or older by July 1 of any applicable tax year Property must be an owner-occupied single-family residence house condo townhome An exemption application must be filed annually before June. To qualify for Measure K or Measure L senior low-income exemption.

Your property taxes would remain at 3500 instead of the new rate of about 12500 per year for a 1M house. To qualify for an exemption from the Measure C Marin Wildfire Prevention Authority parcel tax homeowners must meet the following criteria. The homeowners exemption reduces the annual property tax bill for a qualified homeowner by at least 70.

Marin Countys Property Tax Exemption webpage has a lot of the information you need for most but not all of the taxes and fees that could impact you. Additionally parcels which are classified by County Assessor Use Codes 15 and 53 90 are also exempt from this tax.

For Seniors Keeping Your Property Taxes Low

For Seniors Keeping Your Property Taxes Low

Property Tax Re Assessment Bubbleinfo Com

Lm Marketing Digital E Design Grafico Marketing De Rede Analista De Marketing Marketing

Interactive Map Compares Californians Property Taxes

Understanding California S Property Taxes

Property Tax California H R Block

Understanding California S Property Taxes

What Is A Homestead Exemption California Property Taxes

Sc Johnson S Administration Building Research Tower Exempt From Property Taxes Frank Lloyd Wright Architecture Frank Lloyd Wright Homes Building

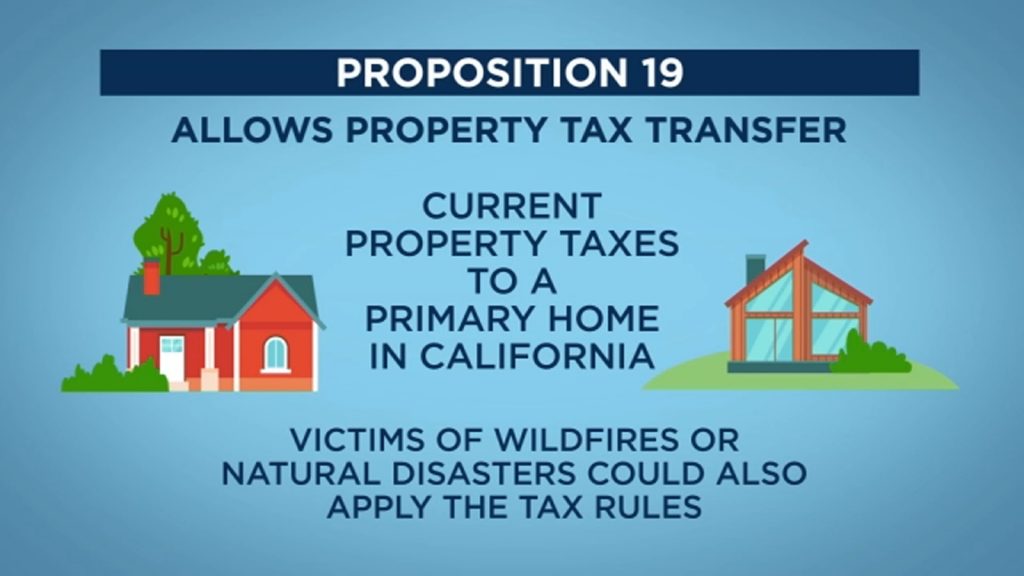

Editorial Confusing New Law Puts Generational Family Wealth At Stake Marin Independent Journal

Transfer Tax In Marin County California Who Pays What

How To Inherit Your Parents House And Their Low Tax Bill Too

Understanding California S Property Taxes

Understanding California S Property Taxes

Lm Marketing Digital E Design Grafico Marketing De Rede Analista De Marketing Marketing